Get the free simple balance sheet

Show details

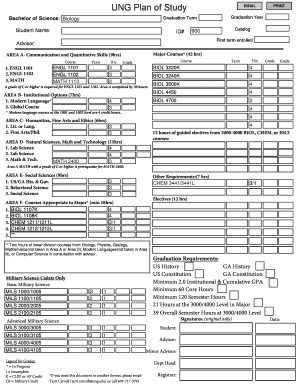

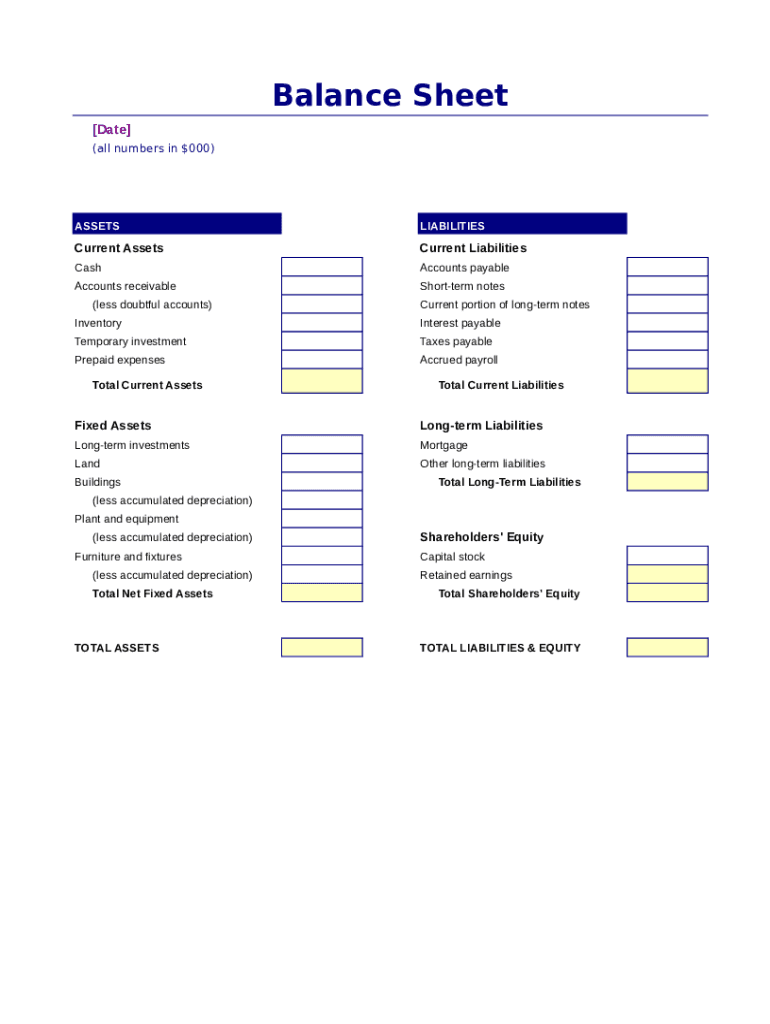

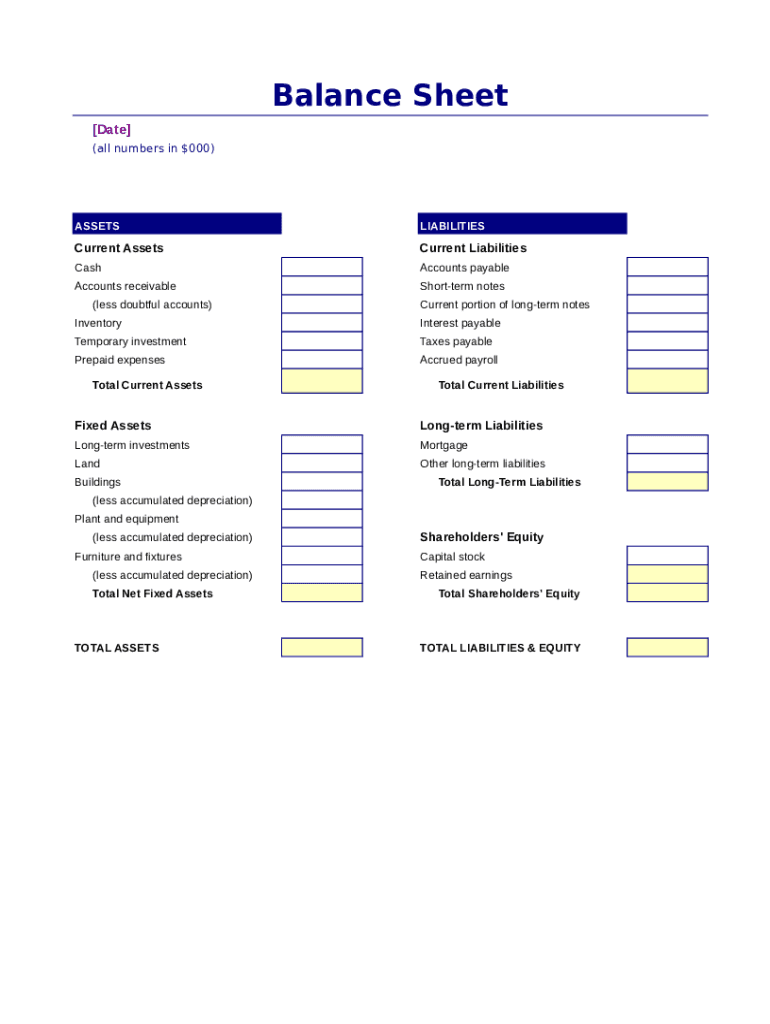

Balance Sheet Date (all numbers in $000)ASSETSLIABILITIESCurrent AssetsCurrent LiabilitiesCashAccounts payableAccounts receivableShortterm notes(less doubtful accounts)Current portion of long term

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign simple balance make form

Edit your balance sheet fill editable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your simple download file form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sheet template create online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit balance sheet fill fillable form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out simple balance type form

How to fill out Simple Balance Sheet Free

01

Gather financial data: Collect all relevant financial information such as assets, liabilities, and equity.

02

Open the Simple Balance Sheet Free tool: Access the online tool or download the template.

03

Input assets: Start by entering all asset values in the designated section, including current and fixed assets.

04

Input liabilities: Next, fill in all liability values, separating current and long-term liabilities.

05

Calculate equity: Subtract total liabilities from total assets to determine owner's equity.

06

Review balances: Ensure that total assets equal total liabilities plus equity to maintain balance.

07

Save and export: Once complete, save your balance sheet in the desired format, such as PDF or Excel.

Who needs Simple Balance Sheet Free?

01

Individuals tracking personal finances.

02

Small business owners needing financial clarity.

03

Students studying accounting or finance.

04

Non-profit organizations managing funds.

05

Consultants providing financial guidance to clients.

Fill

simple download form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is simple balance sheet?

A simple balance sheet is a financial statement that reports a company's assets, liabilities and shareholders' equity at a specific point in time. Assets include cash, accounts receivable, inventory and fixed assets such as property and equipment. Liabilities include accounts payable, loans and accrued expenses. Equity represents the net assets or net worth of the company. The balance sheet indicates the company's financial position at a given point in time.

What is the purpose of simple balance sheet?

The purpose of a simple balance sheet is to provide a snapshot of a company’s financial position at a particular moment in time. It lists a company’s assets, liabilities, and equity and provides a useful tool for assessing the financial health of the business. This makes it an important document for investors, creditors, and management to understand.

How to fill out simple balance sheet?

1. Start by finding the total assets and liabilities. Assets are anything that the company owns, such as cash, accounts receivable, inventory, and equipment. Liabilities are any debts or obligations that the company has, such as accounts payable, payroll, loans, and taxes.

2. Next, enter the total assets and liabilities into the balance sheet. Assets should go on the left side of the balance sheet, and liabilities should go on the right side.

3. Then, enter the individual assets and liabilities into the balance sheet. For each asset, enter the amount of the asset on the left side of the balance sheet. For each liability, enter the amount of the liability on the right side of the balance sheet.

4. Finally, add up the total assets and liabilities to make sure that the total assets equal the total liabilities. If the two totals are not equal, then there is likely an error in the balance sheet.

What information must be reported on simple balance sheet?

A simple balance sheet typically includes the following information:

1. Assets: cash, accounts receivable, inventory, prepaid expenses, investments, property, equipment, and other assets

2. Liabilities: accounts payable, loans, taxes, and other liabilities

3. Equity: retained earnings, common stock, and other equity accounts

4. Total assets, total liabilities, and total equity

Who is required to file simple balance sheet?

There is no specific requirement for who is required to file a simple balance sheet. However, businesses and organizations typically prepare and file balance sheets as part of their financial reporting obligations. Additionally, individuals may choose to create a personal balance sheet to assess their financial health and track their assets and liabilities. The need to file a balance sheet may also be dictated by regulatory or legal requirements specific to certain industries or situations.

How do I make changes in balance sheet?

With pdfFiller, the editing process is straightforward. Open your simple create document in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit sheet template online straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing simple template download form.

How do I complete simple sheet sign editable on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your simple online form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is Simple Balance Sheet Free?

A Simple Balance Sheet Free is a financial document that summarizes the assets, liabilities, and equity of an organization in a straightforward manner, intended for simplified financial reporting.

Who is required to file Simple Balance Sheet Free?

Typically, small businesses, sole proprietorships, or organizations with limited financial transactions are required to file a Simple Balance Sheet Free, often depending on local regulations and financial thresholds.

How to fill out Simple Balance Sheet Free?

To fill out a Simple Balance Sheet Free, list all assets and their values on one side, total these values, then list liabilities and equity on the opposite side. Ensure that the accounting equation (Assets = Liabilities + Equity) is satisfied.

What is the purpose of Simple Balance Sheet Free?

The purpose of a Simple Balance Sheet Free is to provide a clear snapshot of a company's financial position at a specific point in time, enabling stakeholders to assess its solvency and overall financial health.

What information must be reported on Simple Balance Sheet Free?

A Simple Balance Sheet Free must report information such as current and non-current assets, current and non-current liabilities, and shareholders' equity.

Fill out your Simple Balance Sheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fillable Balance Sheet is not the form you're looking for?Search for another form here.

Keywords relevant to simple sheet sign form

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.